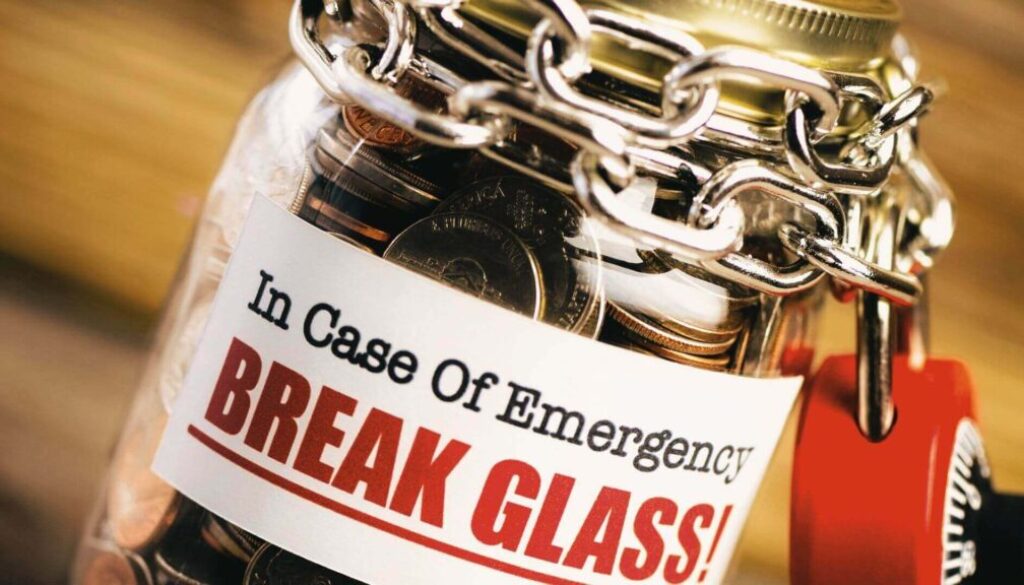

Strategies for Building and Using Your Emergency Fund Effectively

An emergency fund is your financial reserve for when life is at its most unpredictable, but creating it and utilizing it when it’s necessary is a science. As you must have set your savings objective, this blog post would help you find out how to grow the fund and when it is right to spend it.

6 Strategies for Establishing an Emergency Fund

- Start Small, Save Often — Take your target and divide it into targets that you can easily achieve within a given period of time. Celebrate when you reach each target to stay motivated.

- Automate Your Savings — Conduct direct debit by moving money from your current bank account to a savings bank account. Your emergency fund should be viewed as such an expense that has to be paid on a monthly basis.

- Redirect Windfalls — Motivate your savings through the usage of bonuses, tax refunds, or monetary gifts. Spend a fraction of any additional cash you receive on the fund (gradually devote at least 50% of extra income).

- Cut Back on Non-Essentials — List non-negotiable items (i.e., Netflix, eating out) that one can shut down or lessen, especially during lean months. Take the savings that you will be making every month and deposit it to your emergency fund.

- Choose the Right Account — It is wise to keep your emergency fund in either a high-yield savings account or a money market account. Just make sure it is convenient for you, but not part of your regular monthly and weekly expenses.

- Track Your Progress — It is important to track the kind of savings made from time to time. Change your contribution if you have alterations in your spending habits or in your target.

When to Use Your Emergency Fund

Not all expenses, which arise without any prior planning, are worthy of being called emergencies. Use your fund wisely by asking these questions:

- Is this expense urgent and necessary? Examples: medical emergencies, major car repairs, or essential home fixes. Non-urgent expenses, like sales on gadgets or nonessential travel, don’t qualify.

- Is there no other way to pay for this? Exhaust other non-emergency resources first (e.g., a flexible budget or sinking fund).

Examples of Legitimate Emergencies:

- Medical: Unexpected operations, a visit to the dentist, or other necessary drugs that are not covered by the insurance.

- Job Loss: Supporting the rent, the electricity bill, or food expenses until a new source of income can be found.

- Essential Repairs: Heating water, a leaky roof, or a car not starting.

When Not to Use Your Emergency Fund:

- To fund a vacation or holiday shopping spree.

- Pre-planned purchases, such as purchasing new office furniture or an operation in a hospital when you are not ill, among others.

- To buy merchandise in order to seize sales or “promotions.”

Protecting and Replenishing Your Emergency Fund

Always make sure to restore your emergency fund once you have had to utilize it. Here’s how:

- Pause Non-Urgent Spending: Pay the necessary amount back to the emergency fund until this category is filled to the maximum.

- Increase Savings Temporarily: Spend a part of your income in this direction so as to build up your fund for a certain time period.

- Reflect on the Expense: If the emergency could have been foreseen, you may want to consider setting up another sinking fund for similar occurrences in the future.

Final Thoughts

Creating an emergency fund is a slow and methodical process, yet it is totally worth the effort once implemented. By following these tips and using your fund only in cases of absolute necessity, you would be able to make it the best safety cushion for you that you can avail in moments of need.