Trading Apps — What They Are and How They Work

Introduction

Trading apps have changed the way people interact with the stock market. Years ago, placing a trade usually required contacting a traditional broker, using a desktop computer, and paying fees for every transaction.

Today, the process looks entirely different. Anyone with a smartphone and a trading app can set up an account and trade on their own. This shift has resulted in a significant increase in everyday people entering the markets, many of whom begin with small sums of money.

Before diving into the concerns surrounding these apps—something we’ll explore in the next blog—it helps to first understand what trading apps are, how they operate, and why so many people use them today.

What Are Trading Apps?

Trading apps are mobile applications that enable users to purchase and sell a variety of financial assets, including stocks, ETFs, cryptocurrencies, and options. They work like digital brokerage platforms, letting investors manage their accounts right from their phones. In short, they are like smaller versions of regular brokerage accounts. These tools are arranged in a way that makes the process straightforward, even for people who are new to investing.

How Trading Apps Work

Although trading apps use complex financial and technological infrastructure behind the scenes, the front-end experience is intended to be simple. Here’s a straightforward look at the typical steps:

1. Registration & Verification

The process starts with the user downloading the app, then they enter their personal details, verify their identity, and link their bank account. Verification is necessary because brokerages have to follow rules like Know Your Customer (KYC) and anti-money laundering rules.

2. Funding the Account

Usually, money is sent through ACH deposits, bank transfers, or debit card transfers. Some apps let you make deposits right away, but bigger transfers might take longer to go through.

3. Researching & Browsing Investments

Trading apps consolidate a wide range of market information in one place, giving users access to stock charts, analyst ratings, company profiles, historical performance data, earnings reports, real-time market news, and customizable watchlists. With all of this information available in a single platform, users can research thousands of stocks and ETFs before deciding whether they want to place a trade.

4. Placing Trades

To execute a trade, users select the asset they are interested in, choose an order type—such as market, limit, or stop-loss—and confirm the transaction. The app then routes the order to market makers or exchanges for execution.

5. Real-Time Alerts & Monitoring

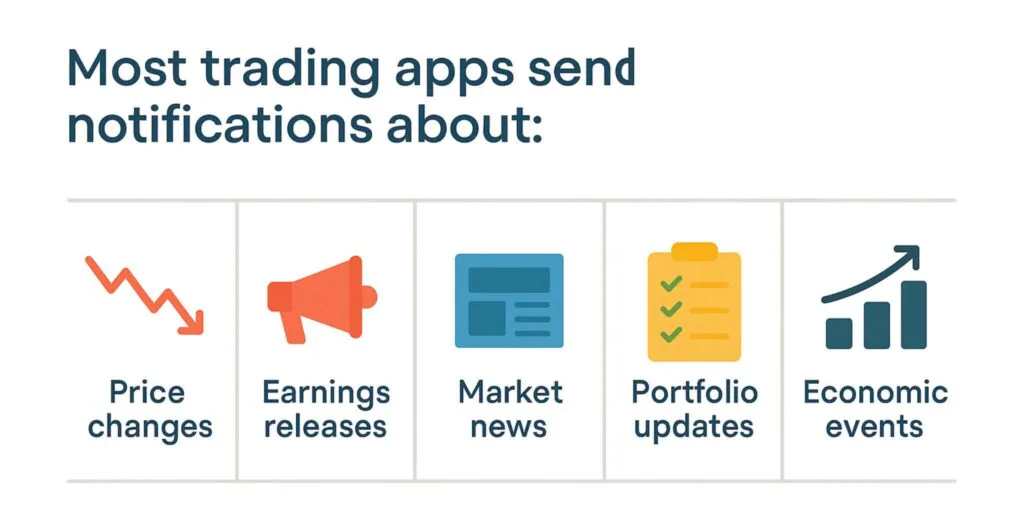

Most trading apps send you real-time notifications about everything from changes in price and earnings reports to market news, changes to your portfolio, and big economic events. These alerts keep users up to date on changes in the market, giving them a never-ending stream of information.

Why Trading Apps Became So Popular

Trading apps have seen a huge rise in popularity over the past decade, and several key trends explain why they’ve become such a common way for people to interact with the stock market.

1. Zero-Commission Trading

For years, trading often came with added costs, especially for smaller investors who paid a fee every time they bought or sold a stock. When many platforms shifted to zero-commission trading, those fees disappeared. This change made it easier for people to place smaller or more frequent trades without worrying about extra charges stacking up.

2. Interfaces Designed for Beginners

The design of most trading apps is intentionally simple. Clean screens, clear buttons, and short explanations make the experience feel less intimidating for people who are just starting out. Instead of navigating complicated menus, users can access tools and information with only a few taps.

3. Access to Fractional Shares

Fractional shares opened the door for users to purchase pieces of higher-priced stocks. Instead of needing the full price of a share from companies that trade at hundreds of dollars, people can choose the amount they want to invest. This feature has made well-known companies more reachable for smaller portfolios.

4. Real-Time Technology

Mobile trading fits naturally into the fast-paced digital environment people are used to today. Apps provide live price updates, quick order execution, and immediate access to market information. Having this data available at any moment makes the experience feel up-to-date and on demand.

5. Influence of Social Media

Social media now plays a significant role in how people learn about investing. Short videos, online discussions, and trending topics about stocks have made trading part of everyday conversation. This visibility has contributed to more people downloading and exploring trading apps.

6. Growing Preference for Instant Digital Tools

There has been a broader cultural shift toward using apps for nearly everything—from banking to food delivery. Trading apps fit right into this expectation of instant access. They provide quick, convenient tools for people who prefer managing tasks through their phones rather than traditional platforms.

Final Thoughts

Trading apps have opened the door to a new way of accessing the markets. They’re simple, fast, and packed with information that once required far more effort to find. Knowing how these apps work is an important first step before examining the larger questions—like where these tools excel, where they fall short, and what issues they raise within the market.