How Inflation Quietly Taxes Your Money

Inflation: The Tax You Never See

When we think about taxes, we usually think of the ones we can see, like the sales tax, property tax, income tax, or payroll tax. These are clearly marked and taken off right away. But the most powerful tax that most people pay never shows up on a bill.

That tax is inflation.

Every year, inflation quietly lowers the value of your money. You don’t get a notice. There is no discussion or vote. But its effects can be worse than those of many other taxes put together.

What Inflation Really Does

Inflation is the steady rise in prices across the entire economy over time. The Consumer Price Index (CPI) is a common way to measure inflation, as it tracks changes in the cost of everyday necessities such as food, housing, transportation, healthcare, and education.

By tracking how much more (or less) we pay for these essentials over time, the CPI helps show whether the purchasing power of the U.S. dollar is increasing or declining. When CPI rises, it means the same amount of money buys fewer goods and services than before—effectively reducing the real value of income and savings, even if dollar amounts stay the same.

Even modest inflation has powerful long-term effects:

- At 2% inflation, purchasing power is cut in half in about 35 years

- At 3% inflation, it happens in roughly 24 years

- At 5% inflation, it happens in just 14–15 years

This compounding effect is why inflation is often underestimated—and why its impact is felt most over long periods of time.

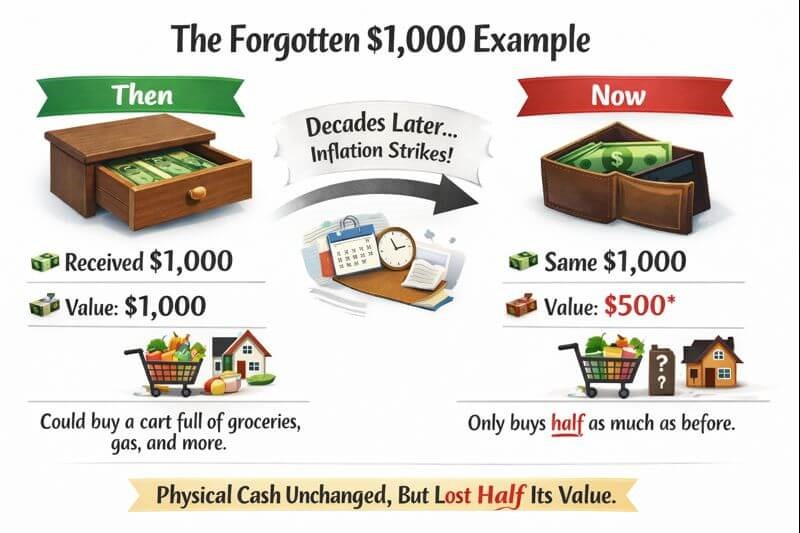

The Forgotten $1,000 Example

Think about getting $1,000 years ago and putting it in a drawer. You never used it. You find it again years later.

It’s still $1,000 on paper. In reality, it might only buy what $500 used to buy.

No one actually took the money. Over time, it just lost value. This is why inflation acts like a tax: it takes away buying power without doing anything directly.

How Inflation Works Like a Tax

Inflation and taxes have a lot in common:

- It makes real wealth less valuable.

- It has an effect on everyone who has money

- It hurts people who save money and people who live on a fixed income more than others.

- It builds up slowly over time.

Inflation hurts people who hold money, not people who earn it, unlike income taxes.

This concept has long been emphasized in financial education, including commentary from Markowski Investments and broader market discussions on Watchdog on Wall Street.

Inflation Isn’t the Same Everywhere

National inflation averages often hide local realities. Housing, insurance, and population growth can dramatically change how inflation is experienced depending on location.

A clear example is Florida, where rising housing and insurance costs have driven inflation well above national norms. For many households, inflation isn’t theoretical—it’s felt in rent, groceries, and insurance bills every month.

Why Inflation Often Goes Unnoticed

Inflation rarely arrives as a shock. Instead, it creeps:

- A little more money spent on groceries

- Slowly going up in rent

- Insurance costs are going up

- More expensive healthcare and education

Each increase feels manageable on its own. Over time, the cumulative effect becomes overwhelming.

What To Remember

Most of us don’t understand inflation, which is the most powerful tax we pay. It doesn’t take money away from people, but it makes it less useful over time. The first step to protecting your long-term buying power is to understand this fact.